P2P financing is a way for individuals or businesses to request funds from investors via a digital platform. The digital platform is an intermediary between the requestor and the investor. Multiple investors can contribute their funds towards a request made by a borrower. These platforms essentially connect borrowers seeking financing to investors seeking attractive returns.

From its modest beginning in the UK and the U.S, peer-to-peer (P2P) lending has become a global phenomenon and this alternative financing has experienced an explosive growth particularly in Asia at the turn of the decade. Asia’s large population of smartphone-savvy and unbanked makes it a prime market for financial alternative that leverage digital platforms and technology to provide businesses and individuals with financing opportunities outside of the traditional finance system.

In KPMG’s 2016 Fintech 100 report, two of the world’s top five fintech companies were Chinese P2P lenders while market for licensed money lenders has increased exponentially over the past five years in countries like Hong Kong, Singapore and Malaysia, filling the void in the countries’ financial system which tended to favour larger enterprises.

Looking into the maturity of P2P industry in the US, UK and China while targeting its population of around 640 million, the Southeast Asia region is the region many had confidence to foray into. The region is also home to a huge swath of unbanked communities and “P2P platforms can bring the banks to the borrowers’ doorsteps”. However, local element will play a crucial role in the nascent growth of the P2P industry in the region as Southeast Asia is still very fragmented albeit being a huge market of opportunity. Unlike in China, a uniform set of rules and regulations across multiple jurisdictions is not sufficient especially if the industry regulatory frameworks are relatively underdeveloped.

Many still believe the conveniences and penetration of mobile technology with the younger generation leapfrogging, the time taken for P2P to become mainstream in ASEAN will be much shorter than the time taken for the e-commerce industry to flourish in the region.

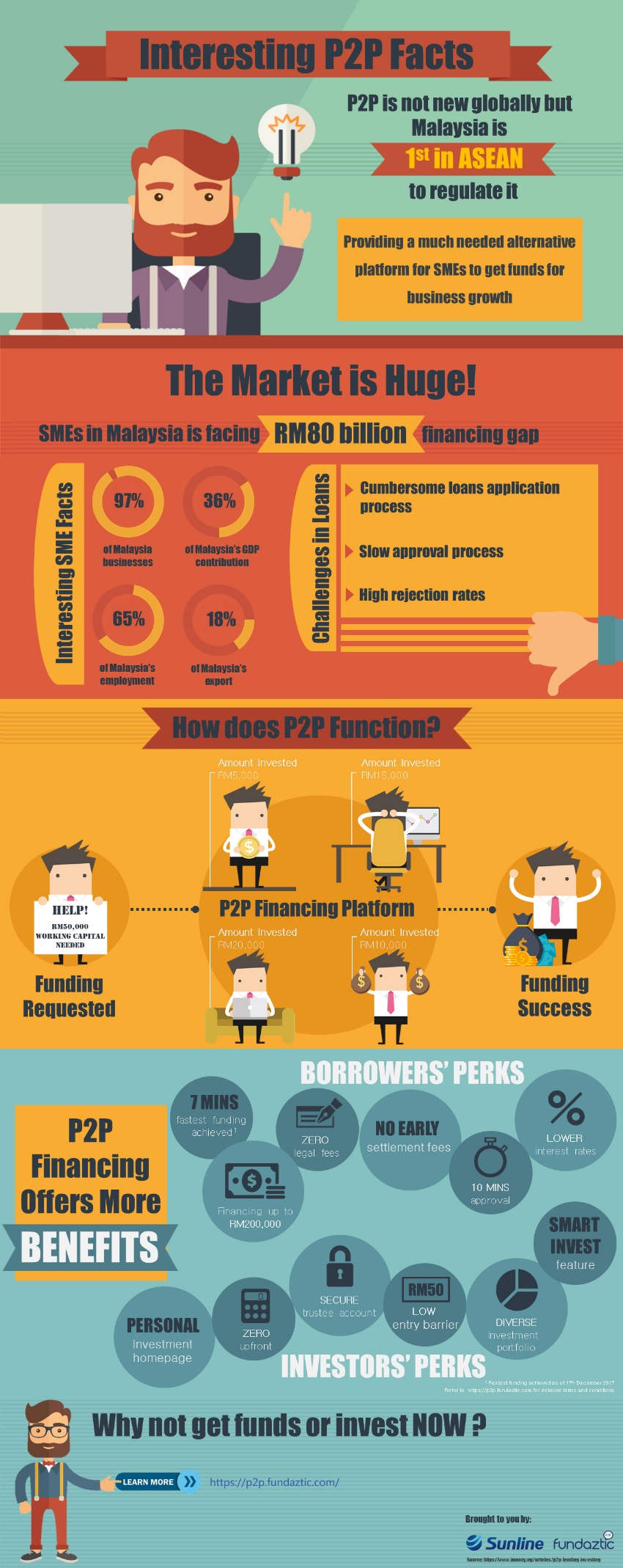

Although P2P is no stranger globally, Malaysia is the first ASEAN country to regulate it. As an effort to expand financing access for SMEs, the SC Malaysia appointed six P2P operators to run P2P financing platforms Fundaztic is fully owned and managed by Peoplender Sdn Bhd, one of the six recognised market operators licensed by the Securities Commission (SC) of Malaysia to operate a peer-to-peer financing platform.

Competing with more than a thousand start-ups for the golden opportunity to be on stage in Hong Kong and emerge champion in Next Money Asia 2018 Fintech Finals (FF18), Fundaztic’s mission to “democratize lending and investment by providing rates equitable to risks via reliable big data and technological leverage” aims to enhance access to both financing and investment for businesses. Their insightful presentation at the semi-finals had remarkably depicted how P2P financing is revolutionizing financial services and is paving the way for the future. FF18 is organized through a collaboration between NextMoney and VISA. With the world’s best speakers assembled to cover FinTech designs, innovation and entrepreneurship, FF18 is also the centre stage where the top 24 start-ups globally will be pitching about their company for the grand prize.

Bridging an RM80 Billion Funding Gap in Malaysia

The number of small and medium enterprises (SME) are rising in parallel to the growing digital economy in Malaysia. Making up to 97% of business establishments, contributing 37% of the country’s Gross Domestic Product (GDP), 65% to the country’s workforce and nearly 18% of Malaysia’s exports, SME plays a major role in the Malaysian economy.

How Does P2P Financing Work?

To simplify the process of P2P financing for an SME, let’s look at an example:Company A need RM50,000 working capital for its business. Company A raises this funding request via a P2P financing platform online. On the other hand, this request offers an investment opportunity to potential investors. Interested investor will lend his money to Company A after considering the risk profile and credit assessment. Investors may choose to deposit RM100 or even RM10,000 depending on their risk appetite. The funding continues until the target of RM50,000 is achieved. At this point the offering will be closed, and the funding will be released to the borrower. Company A makes monthly repayments including interest charges to each investor.

Interest rates are calculated based on the credit assessment and risk profile of the borrower’s company by the P2P financing platforms which requires disclosure of key details including but not limited to financial information, business plans and purpose of funds. SC Malaysia has declared that interest rates to be capped at 18% per annum with credit scoring methodologies made transparent to both investors and borrowers. Charges for services rendered by P2P financing platforms may vary. Digital platforms greatly expand the number of investors and funding can typically be obtained within 1-2 weeks after submission.

Like any other investments, risk is always present in P2P financing. Instances where borrowers default on their payments will leave investors in losses. However, wise assessments on the SME prior to investing will minimize such risks. Successful P2P investors have hundreds of loans across different P2P financing platforms and most reinvest their returns.

For borrowers, they can get better rates on their interest charges while investors can get better returns on their investments. It’s a win-win situation!