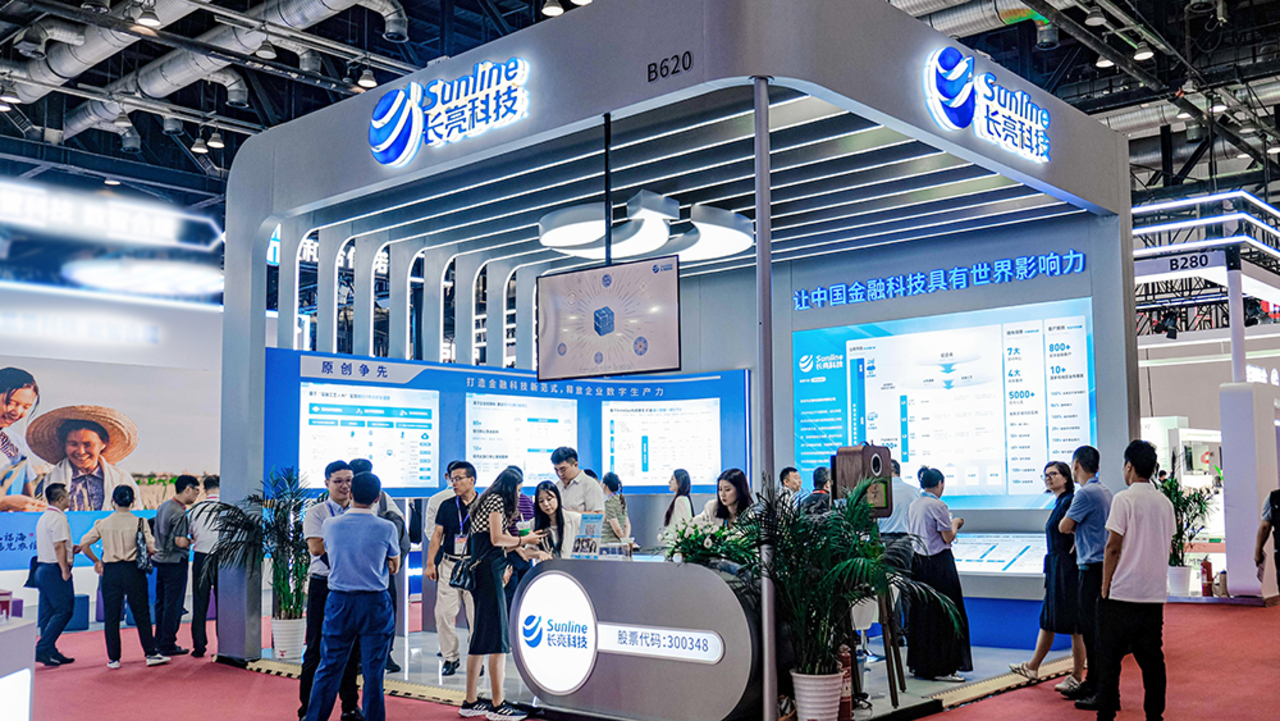

July 21, 2024, Beijing - The China International Financial Exhibition 2024, spanning three days from July 19th to 21st, concluded successfully at the China National Convention Center. Throughout the exhibition, Sunline impressively demonstrated its technological prowess and forefront position within the fintech industry.

At the Financial Exhibition, Sunline showcased numerous innovative achievements and leading practices, drawing a vast crowd of financial institution leaders, industry experts, and partners who engaged in lively exchanges. Together, they delved into practical experiences and forward-looking insights pertaining to the digital and intelligent transformation of the financial industry.

Innovative Implementation Process + AI: Reshaping the Future of Efficient R&D

Leveraging extensive experience in project implementation, Sunline has introduced an innovative implementation process that spans all stages, including requirements, analysis, design, development, testing, deployment, and transition. This approach ensures that IT systems comprehensively and accurately meet business needs, thereby facilitating smooth project execution.

As the era of artificial intelligence unfolds, Sunline envisions that software engineering will evolve towards intelligent programming and AI-driven models. In response, the company has pioneered a cutting-edge integration of "Implementation Process + AI." By transforming traditional business requirements into structured digital assets, this advancement shifts the focus from code-driven development to asset-driven development. Additionally, generative AI technologies provide intelligent support throughout various R&D stages, enabling banks to redefine their development processes and achieve efficient, intelligent system construction.

Leading Innovation: Establishing a New Paradigm in Fintech

Digital and intelligent transformation is emerging as a new avenue for financial institutions to build core competitive advantages. At the Financial Exhibition, Sunline showcased a series of advanced, mature, and independently controllable products, solutions, and exemplary cases. These offerings precisely address the urgent needs in the transformation process of financial institutions, helping them seize opportunities in the digital era and achieve continuous business upgrades and optimizations.

Modernizing Core Banking Systems: Pioneering a New Paradigm in Core Construction

Leveraging enterprise architecture frameworks, Sunline is developing microservice-based enterprise application capabilities to build modern core banking systems. This approach enhances the integration of technology and business and fosters innovation within the banking sector.

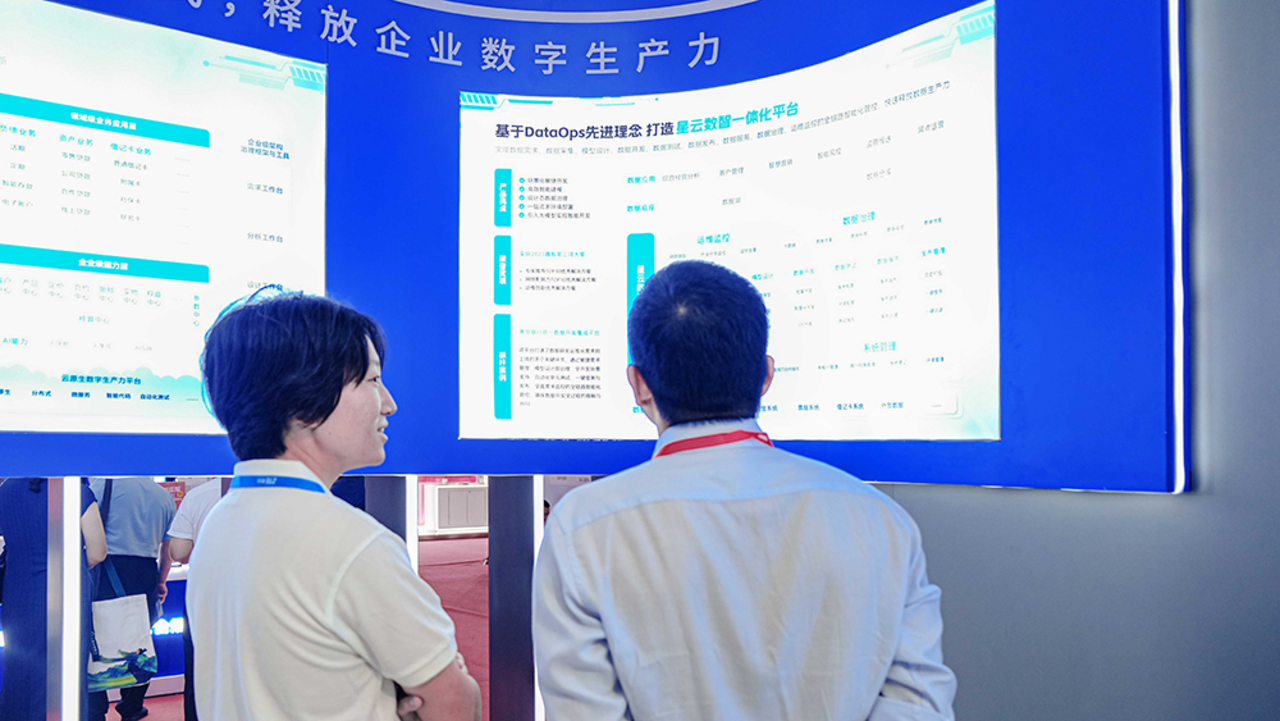

Nebula Integrated Digital Intelligence Platform: Rapidly Unleashing Data Productivity

Built on the advanced DataOps concept, Sunline's one-stop data operations platform enables end-to-end intelligent management from data requirements and collection to governance and operational monitoring. This platform swiftly unleashes data productivity.

Domestic Large Ledger System: Leading the Financial Digitalization Era

The next-generation enterprise-grade general ledger system integrates functions such as measurement, accounting, management, and analysis. Fully supporting domestic software and hardware environments, it has become the trusted choice for financial institutions seeking digital and domestic upgrades in ledger management.

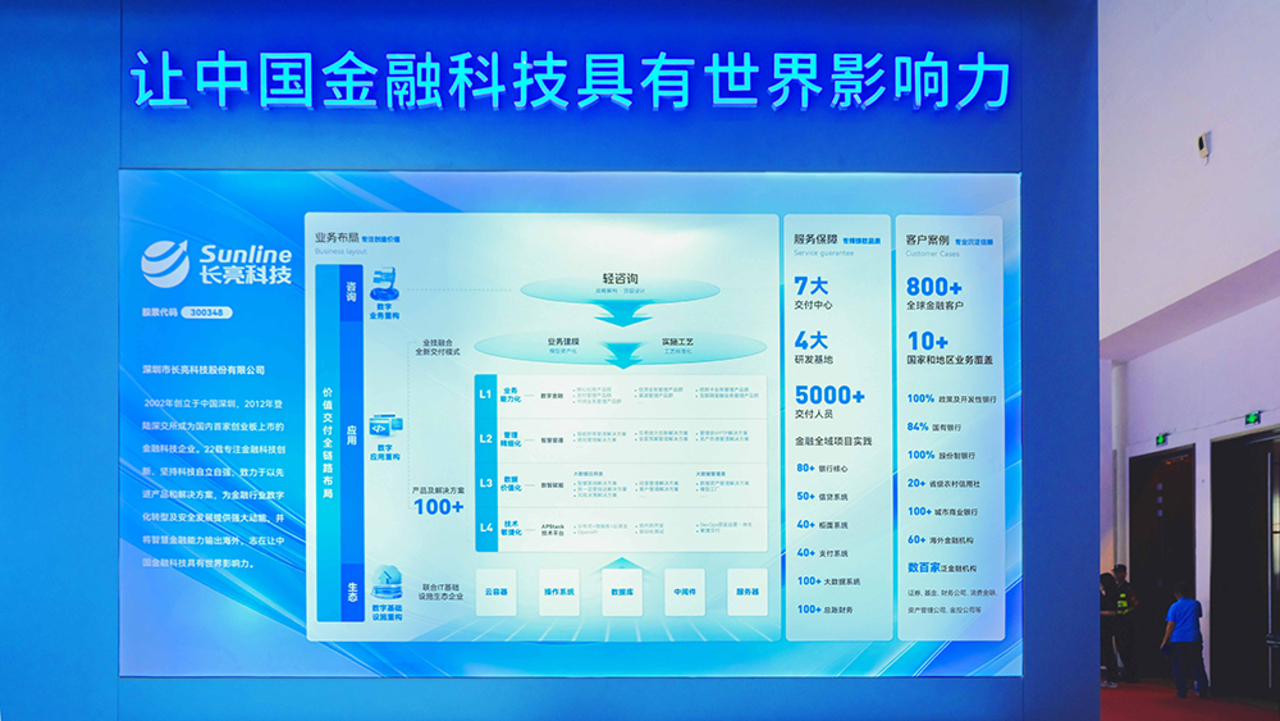

Global Perspective: "Concept + Technology + Innovation" Expands Overseas

Building on its advanced domestic products and solutions, Sunline began exploring international markets in 2016, committed to exporting China's best practices in digital transformation to global markets. At the Financial Exhibition, Sunline presented leading practices from a global perspective, empowering Indonesia's BNC Bank to achieve a significant leap in its digital transformation and establish itself as a top digital bank in Indonesia.

Sunline has expanded its business footprint to over 10 countries and regions, providing in-depth services to more than 60 overseas financial institutions. This expansion not only highlights the global reach of its technological capabilities but also sets Sunline as a benchmark for Chinese fintech companies on the international stage.

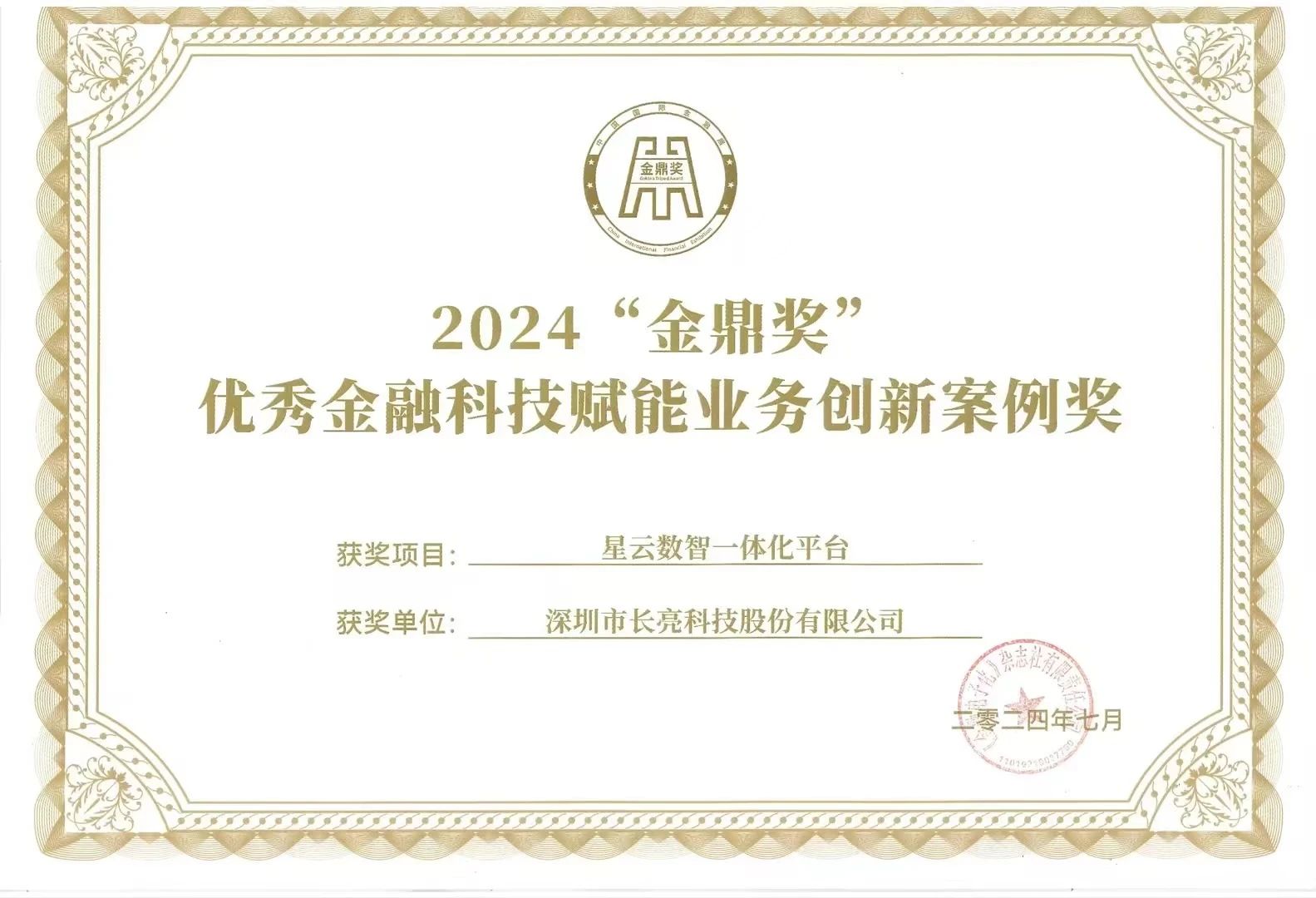

Moment of Glory: Award for Outstanding Fintech Empowerment in Business Innovation

Sunline’s "Nebula Integrated Digital Intelligence Platform" received the "Outstanding Fintech Empowerment in Business Innovation" award at the Financial Exhibition's "Golden Tripod Award." This recognition highlights the platform's exceptional performance in data operations and its practical success in enhancing data development efficiency for financial institutions. This accolade signifies Sunline's distinguished expertise in the financial big data sector and its high regard from industry experts.

Looking to the future, Sunline will continue to embrace a spirit of innovation, exploring the deep integration and innovative practices of cutting-edge technologies in financial scenarios. Partnering with more players in the financial industry, Sunline aims to collectively shape a more open, inclusive, and secure future for financial technology.

About China International Financial Exhibition 2024

The 2024 China International Financial Exhibition was held from July 19th to 21st, 2024, at the Beijing National Convention Center. This year’s financial exhibition, with the theme “Digital Finance Leading the Future – Upholding Integrity and Innovation to Build a New Financial Ecosystem,” showcased the high-quality services provided by the financial sector to economic and social development through a multi-dimensional exhibition and a series of activities. It highlighted the outstanding achievements in the five major areas of technology finance, green finance, inclusive finance, elderly care finance, and digital finance.

About Sunline

Sunline established in 2002, is a high-tech enterprise focused on providing comprehensive IT solutions and services for the financial industry. Sunline is actively expanding in the overseas market, concentrating on delivering digital core solutions and specialized services such as bank forex management to overseas financial institutions, particularly in countries along the Belt and Road Initiative like those in Southeast Asia. With its profound technological expertise and deep understanding of financial business, Sunline has become a leading fintech solutions provider both domestically and internationally. It assists clients in achieving digital transformation and business upgrades, driving the development of intelligent and convenient financial services.