Sunline has successfully secured the contract for the "Personal Non-Performing Loan Business System Construction Project" of a national financial asset management company (hereinafter referred to as a national AMC). This collaboration officially marks the start of Sunline's partnership with national AMCs in the field of personal non-performing loan business. This significant milestone once again underscores Sunline's outstanding strength and profound expertise in the AMC non-performing loan business sector.

The national AMC mentioned is among the five leading nationwide financial asset management companies, holding multiple financial licenses. Its primary operations encompass non-performing asset management and financial services, with non-performing asset management being its core business.

According to the "Annual Report on the Pilot Business of Non-Performing Loan Transfers (2023)," the volume of bulk transfers of individual non-performing loans saw a substantial increase in 2023, with a transaction value of 96.53 billion yuan and 390 individual deals closed, highlighting the gradual emergence of a promising market. For AMCs, developing new productivity driven by data and technological capabilities will bring forth novel growth opportunities in non-performing asset management.

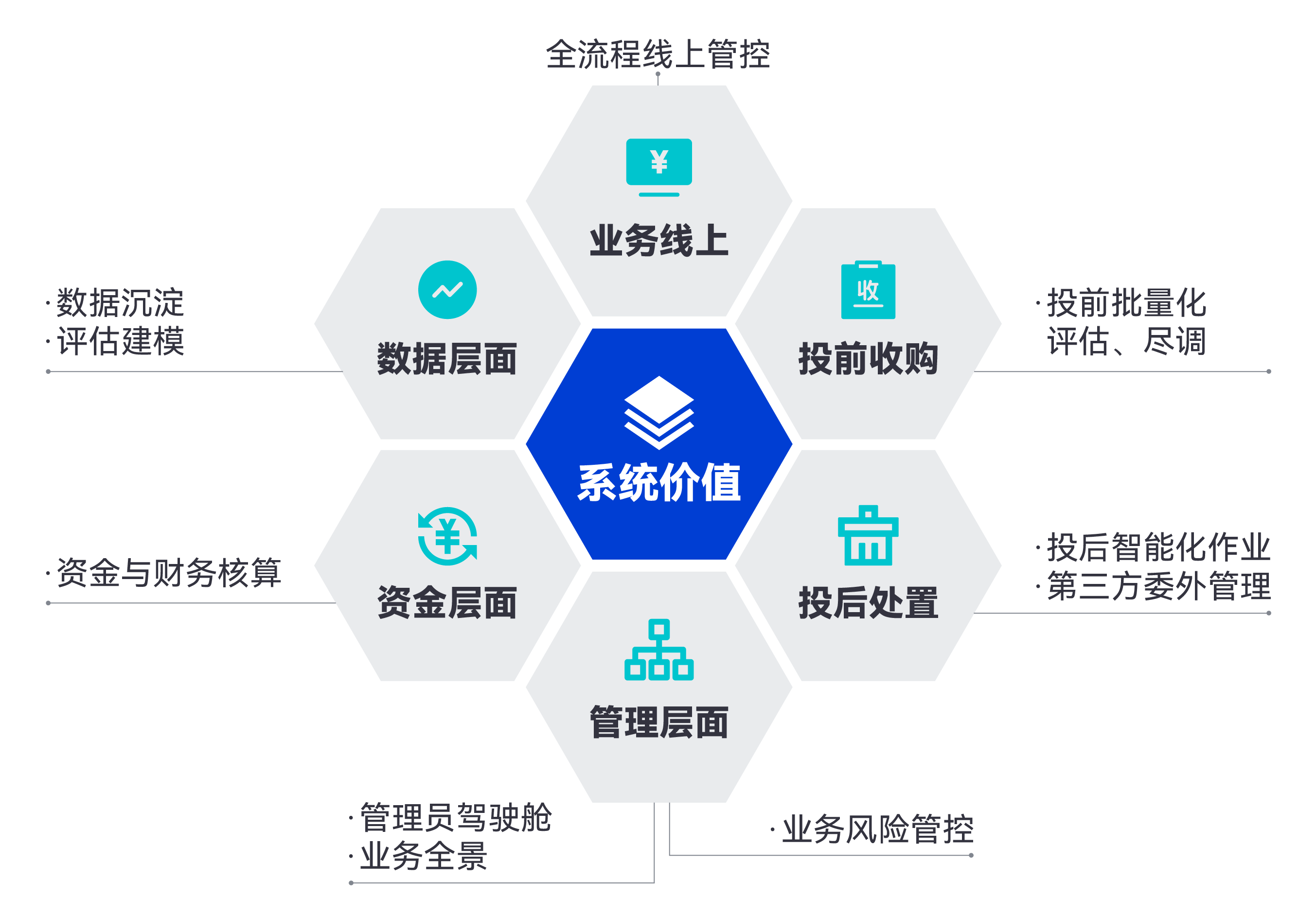

Sunline's Personal Non-Performing Loan Business System products consistently prioritize customer needs at their core, relentlessly pursuing technological innovation. Drawing inspiration from the approach of building core systems for financial institutions, Sunline constructs AMC's Personal Non-Performing Loan Business System to comprehensively address the integration of business and finance throughout the pre-investment, investment, and post-investment stages. This system aims to achieve structural, process-oriented, refined, standardized, and intelligent operations and management, ultimately serving to prevent and mitigate operational risks, standardize business operations, assist in management decision-making, enhance work efficiency, foster business development, reduce management costs, and improve asset management effectiveness.

As one of the earliest vendors to implement AMC's Personal Non-Performing Loan Business System solutions in China, Sunline has been involved in this field since 2020. In recent years, the company has successfully established personal non-performing loan business systems for several leading local AMCs, iteratively refining its offerings and accumulating extensive business and technical expertise. During the bidding process for this national AMC project, Sunline fully leveraged its technological advantages and business capabilities, tailored a practical solution that aligns with the AMC's needs and future plans.

This win marks another milestone for Sunline in the retail credit sector, following its successful bid for a provincial bank's new online lending project earlier this year. By leveraging technology, Sunline continues to empower various financial institutions in building pre- and post-loan ecosystems for retail credit businesses, fostering a vision of "collaborative development, precise risk control, and ecosystem profitability" across different financial sectors.

At this new juncture of our partnership, Sunline remains committed to the principles of "customer first, technology leadership." With a more professional attitude and efficient services, we will consistently provide this national AMC with superior IT solutions and services, facilitating a more robust transformation towards digitization and intelligence in its personal non-performing loan business. Together, we aim to embark on a mutually beneficial journey, writing a new chapter of successful collaboration.

About Sunline

Sunline established in 2002, is a high-tech enterprise focused on providing comprehensive IT solutions and services for the financial industry. Sunline is actively expanding in the overseas market, concentrating on delivering digital core solutions and specialized services such as bank forex management to overseas financial institutions, particularly in countries along the Belt and Road Initiative like those in Southeast Asia. With its profound technological expertise and deep understanding of financial business, Sunline has become a leading fintech solutions provider both domestically and internationally. It assists clients in achieving digital transformation and business upgrades, driving the development of intelligent and convenient financial services.