In May 2024, Sunline and Bank of Nanjing collaborated to launch Phase I of the Unified Development Integration Platform, liberating the bank's data productivity and enabling high-quality, efficient data delivery. This marks another milestone in their decade-long partnership!

Breaking Boundaries, Unleashing Data Potential

In the era of "data-driven" operations, financial institutions are facing dual challenges of rapidly changing business demands and soaring complexity in data processing. The contradiction between the soaring demand for data and the bottleneck in data productivity has become increasingly apparent. Against this backdrop, DataOps, as a revolutionary data development model, has emerged as a new paradigm for financial institutions to break down collaboration barriers and unleash data productivity. By establishing standardized and integrated data development processes as well as a refined data operation system, DataOps can achieve significant improvements in both efficiency and quality of data product delivery.

As the first city commercial bank listed on the Shanghai Stock Exchange, Bank of Nanjing has prospectively recognized the importance and potential of data as a core production factor. As early as 2018, it proposed a strategic plan to accelerate the construction of a big data system and carefully laid out a "1+2+3+4" data platform architecture. With the increasingly severe dual challenges of soaring data demand and limited delivery capabilities, Bank of Nanjing has taken the lead in introducing the advanced concept of DataOps in order to enhance data development efficiency and respond to the need for large-scale data processing and analysis.

In the innovative practice of financial big data, Sunline has always been at the forefront of the industry, pioneering in the launch of a one-stop data research and operation platform — Nebula Data Intelligence Integrated Platform, which is built based on the DataOps philosophy. This platform enables full-chain intelligent management and control of various links in the data lifecycle, including data research and development, data delivery, data governance, data maintenance, and data operation, making the entire process simpler, more controllable, safer, and more stable.

Based on a deep understanding of the DataOps philosophy and a solid foundation of trust built through a decade of collaboration, Bank of Nanjing joined hands with Sunline in September 2023 to embark on the construction of a unified development and integration platform. This collaboration aims to revolutionize data development processes, enhance data supply capabilities, and achieve rapid response to changes in market demands, providing a powerful driving force for the business development of Bank of Nanjing.

Precise Strategies, Dual Boost in Data Quality and Efficiency

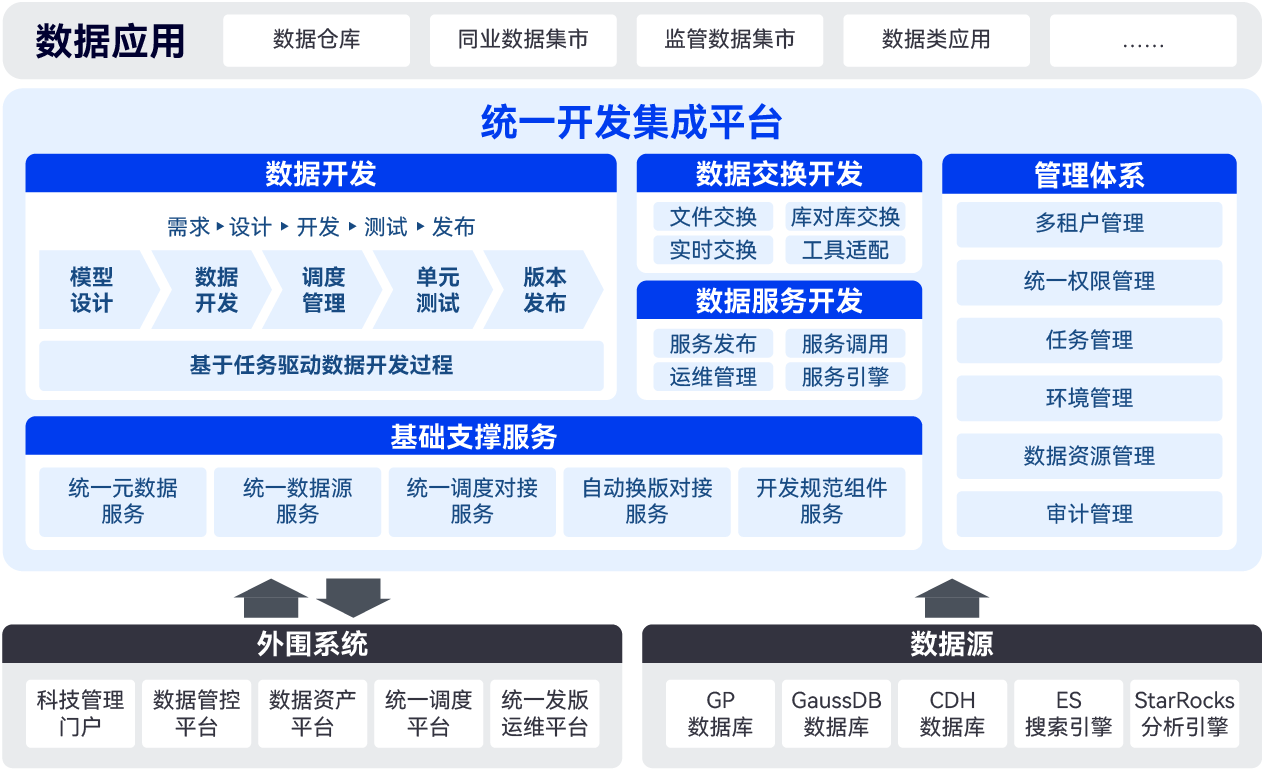

In line with the current digital capabilities of Bank of Nanjing, the Sunline project team adhered to the "reuse principle" to comprehensively integrate and upgrade its existing data products. They integrated the offline development platform, data exchange system, unified scheduling platform, and big data interface publishing system, while also bridging the data asset platform, data management and control platform, various source systems, scientific management, and unified operation and maintenance release platform.

Furthermore, the platform has introduced crucial functionalities such as demand management, process management, data management, version management, and system management. By establishing an enterprise-level one-stop data development platform workstation, it ensures a better, faster, and more agile response to the data development needs of various business segments of Bank of Nanjing, comprehensively enhancing the efficiency and quality of data development.

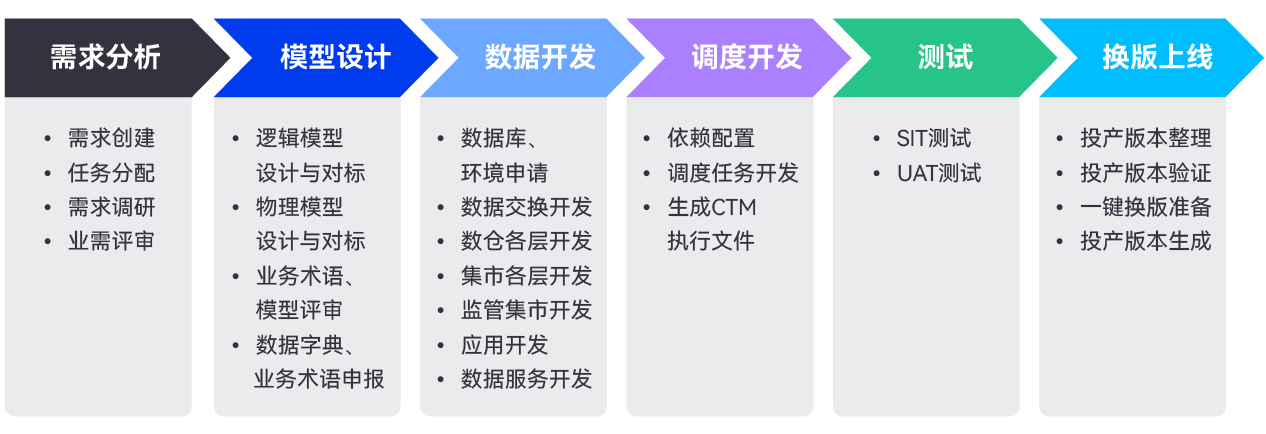

The platform has streamlined multiple crucial steps in the data development, operation, and maintenance process, from demand to deployment. It ensures smooth and collaborative operations throughout the entire data development process through agile demand management, governance via model design, support for all development scenarios, automated unit testing, one-click testing and deployment, and comprehensive demand monitoring, all achieved through full-chain intelligent management and control.

Enhancing Data Quality: The platform has unified the model design and data development specifications for data warehouses, data marts, and data applications, implemented automated unit testing, and thereby improved data quality.

Efficient Cross-Domain Collaboration: It has broken down communication barriers between traditional processes such as demand, design, development, testing, and release, as well as upstream and downstream systems. This has reduced the time spent switching between platforms, promoted efficient collaboration between different departments and domains, and enhanced overall work efficiency.

Standardized Research and Operation Processes: The platform has standardized the research and development processes for various links such as model design, unifying offline processes onto the online platform. This has reduced cumbersome offline procedures, enabling refined operations.

Comprehensive Task Monitoring: It provides comprehensive monitoring of tasks such as demand, model design, data development, and data testing, ensuring the visualization, controllability, and optimization of the data processing process. This improves the efficiency and quality of data delivery, facilitates cross-departmental collaboration, and enhances data security.

The successful launch of the unified data development and integration platform not only meets the high-efficiency data utilization needs of various business departments of Bank of Nanjing, but also lays a solid foundation for the development of its core data projects such as big data platforms, data warehouses, and data marts. It achieves a dual leap in data development quality and efficiency, adding immense momentum to Bank of Nanjing's digital transformation.

In the future, Sunline will continue to support Bank of Nanjing in deepening the construction of the unified data development and integration platform, driving the accelerated release of data value across various business segments, and comprehensively seizing new trends and opportunities in digital economic development.

About Bank of Nanjing

Bank of Nanjing, founded in 1996 and publicly listed on the Shanghai Stock Exchange, is a leading urban commercial bank headquartered in Nanjing, China. With a nationwide network spanning over 250 branches, it offers comprehensive financial services to both individual and corporate customers, including wealth management, consumer credit, and business financing solutions. Renowned for its innovation and customer-centric approach, Bank of Nanjing consistently ranks among the top performers in the industry, demonstrating robust financial growth and commitment to social responsibility.

About Sunline

Sunline is a leading Chinese provider of banking IT solutions and services with over two decades of experience. The company specializes in delivering core banking software and solutions across the Asia-Pacific region. As a leader in scaling up capacity and creating innovations for the financial industry, Sunline has been helping banks accelerate business development to enhance customer experience and digital transformation. Since 2016, Sunline has expanded to the global market, setting up international offices in Singapore, Hong Kong, Malaysia, Thailand, Indonesia, Vietnam, and the Philippines, and extending its footprint to Myanmar and countries in the Middle East. This expansion has enabled Sunline’s influence in fast-growing markets across the region.