After the completion and launch of the first phase of a big data platform upgrading and reconstruction project for a joint-stock bank, Sunline, which led the project, recently won the bid for the second phase of the project again. It will work with the bank to comprehensively implement a safe, efficient, and stable data base based on the achievements of the first phase, helping the bank truly upgrade data resources into data assets.

Ten Years of Collaboration, Unveiling a New Chapter

Sunline has been deeply involved in the field of financial big data for many years, establishing a visible, understandable, and accessible data-driven intelligence system through the integration of data and cloud. This system injects data services with breadth, depth, speed, and precision into business scenarios, accelerating the realization of data value. Since 2020, Sunline has collaborated with a joint-stock bank on data warehouse migration and transformation, successively completing tasks such as data architecture consulting, basic data model planning, adaptive data model transformation, data warehouse and application migration to the cloud over the past two years.

As a joint-stock bank enters a new phase of comprehensive digitization, data has evolved from being a supporting tool for business innovation and operational decision-making to a driving force for customer management and business growth. To address this, the bank faces the critical task of strengthening its big data infrastructure and building a secure, efficient, and stable data foundation that can maximize the value of its data assets.

Faced with the increasing demand for massive data growth and analysis and processing, a joint-stock bank accelerated the construction of its big data system in 2023. With advanced technology and meticulous service, Sunline successfully won the bid for the bank's big data platform upgrade and reconstruction project, helping it upgrade and plan the data model architecture, improving the quality and efficiency of data services, making data utilization more agile and efficient, and enabling more precise cost management.

Consult First, Act with Data

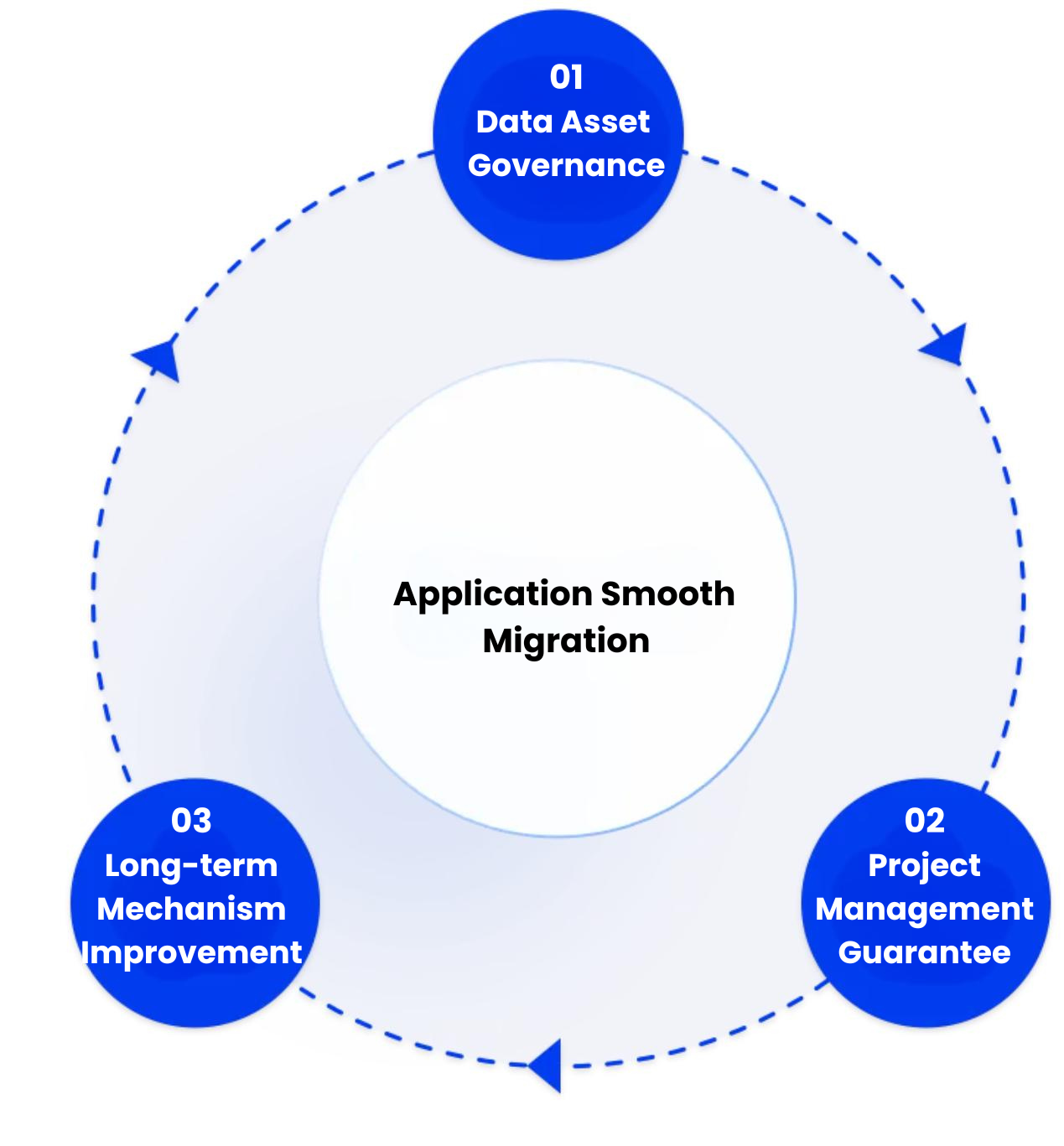

Based on the project construction goals, Sunline's leading role in the big data model reconstruction work adopted a consultative planning approach, targeting the current status of big data construction in a joint-stock bank. It focused on various aspects such as data architecture design, data model reconstruction planning and migration, lean management of data assets, and the construction of long-term management mechanisms. By systematically implementing the "3+1+1" data system, it comprehensively advanced the four core values of efficiency, cost, quality, and timeliness, and created an industry-leading core data warehouse.

Data Architecture Design: Conducting an overall assessment of the bank's data architecture capabilities based on the DCMM national standard, encompassing data system construction, data model, data distribution, data integration, data services, data flow, platform carrying capacity, and data application. Planning improvement directions and implementation paths by incorporating industry-leading practices.

Data Model Reconstruction Planning and Migration: Plan three major data zones, including the source data zone, global shared zone, and application-specific zone. Focus on planning and reconstructing the global shared zone to form a unified data asset system oriented to the business and maximize the value of data business. After the model design is completed, focus on migrating the domain mart layer.

Data Asset Lean Management: Identify and streamline redundant data assets based on new model specifications, and leverage tools to enhance the breadth and accuracy of metadata management.

Long-term Management Mechanism Construction: Establishing long-term mechanisms for asset management, data governance, data development, and organizational support, focusing on organizational structure, tool support, training and empowerment, and cultural cultivation. This guarantees the sustainable management of the big data platform.

Leading in Data, Promising for the Future

The successful implementation of the big data model reconstruction project in a joint-stock bank has pioneered the industry in terms of data architecture, modeling methods, and management thinking, helping the bank maintain its leading position in the industry in big data construction. In this project, the Sunline team demonstrated high professional capabilities in both overall management and technical breakthroughs, with the support of senior experts in data architecture, data modeling, and business consulting, ensuring the comprehensive implementation progress and quality of the project.

Based on the achievements of the first-phase consultation, Sunline will focus on completing the transformation and implementation of the application mart layer of the core data warehouse and peripheral systems in the second-phase project. Additionally, it will continue to promote the governance of data assets, the implementation of management mechanisms, and project management, supporting the comprehensive reconstruction and implementation of the bank's big data platform.

In the future, based on the industry-leading data architecture, data models, and management mechanisms, it will be a matter of ongoing concern for a joint-stock bank to fully implement long-term management mechanisms. Sunline will deeply participate in the deepening of the bank's big data management mechanisms, assisting it in building a strategic force that can adapt to the business development in the digital era from four aspects: organizational management, tool support, training and empowerment, and cultural cultivation. This will enable the bank to continuously advance its digital transformation efforts.

About Sunline

Established since year 2002, Sunline is the leading banking software and technology services company in China. Public listed in year 2012, Sunline has more than 6000 employees worldwide serving beyond 800 banking and finance customers. As the global financial technology leader, Sunline is continuously reinventing our solutions by integrating latest technology trends with industry best practices to provide comprehensive and secure financial solutions.