As a vital pillar in the financial service strategy for rural revitalization, the national agricultural credit guarantee system bridges the gap between government, financial institutions, and farmers, ensuring a steady flow of financial resources to agriculture, rural areas, and farmers. With the continuous evolution of technologies like big data, cloud computing, and artificial intelligence, the rural financial landscape, competitive dynamics, and models of products and services are undergoing profound transformations. Consequently, amidst the drive for digital transformation, identifying a path toward high-quality development for agricultural credit guarantee operations has emerged as a pressing issue.

Heilongjiang Province Agricultural Financing Guarantee Co., Ltd. (referred to as "Longjiang Agri-Guarantee"), a leading enterprise within the national agricultural guarantee system, remains steadfast in leveraging technology to enhance its capabilities. In its ongoing digital transformation journey, the company has consistently achieved pivotal breakthroughs. In 2022, Longjiang Agri-Guarantee partnered with Sunline to initiate the development of a data platform project, focusing on the integration of "Digital Intelligence + Guarantees" to forge new avenues of financially empowering rural revitalization. This strategic collaboration aims to establish a core competitive edge in providing rural financial services.

Charting the Course:

In-Depth Diagnosis and Comprehensive Research

Confronted with a vast number of new agricultural operators scattered across a wide area and their information fragmented across various departments often incomplete, the project team meticulously assessed the current state of Longjiang Agri-Guarantee's data infrastructure. Drawing upon extensive practical experience in big data domains, several issues were pinpointed:

Prominent Data Silos: Data interchange among different departments is hindered, resulting in high communication costs for inter-departmental data collaboration;

Insufficient Data Sharing: The efficiency of data exchange and sharing with external entities such as banks and the National Guarantee Alliance is low;

Data Quality Improvement Needed: Manual input, daily management, report generation, and analytical applications constitute a substantial part of the process, leading to heavy workloads, cumbersome tasks, and challenges in ensuring data accuracy.

Strategy Formulation:

A phased implementation of a customized construction plan

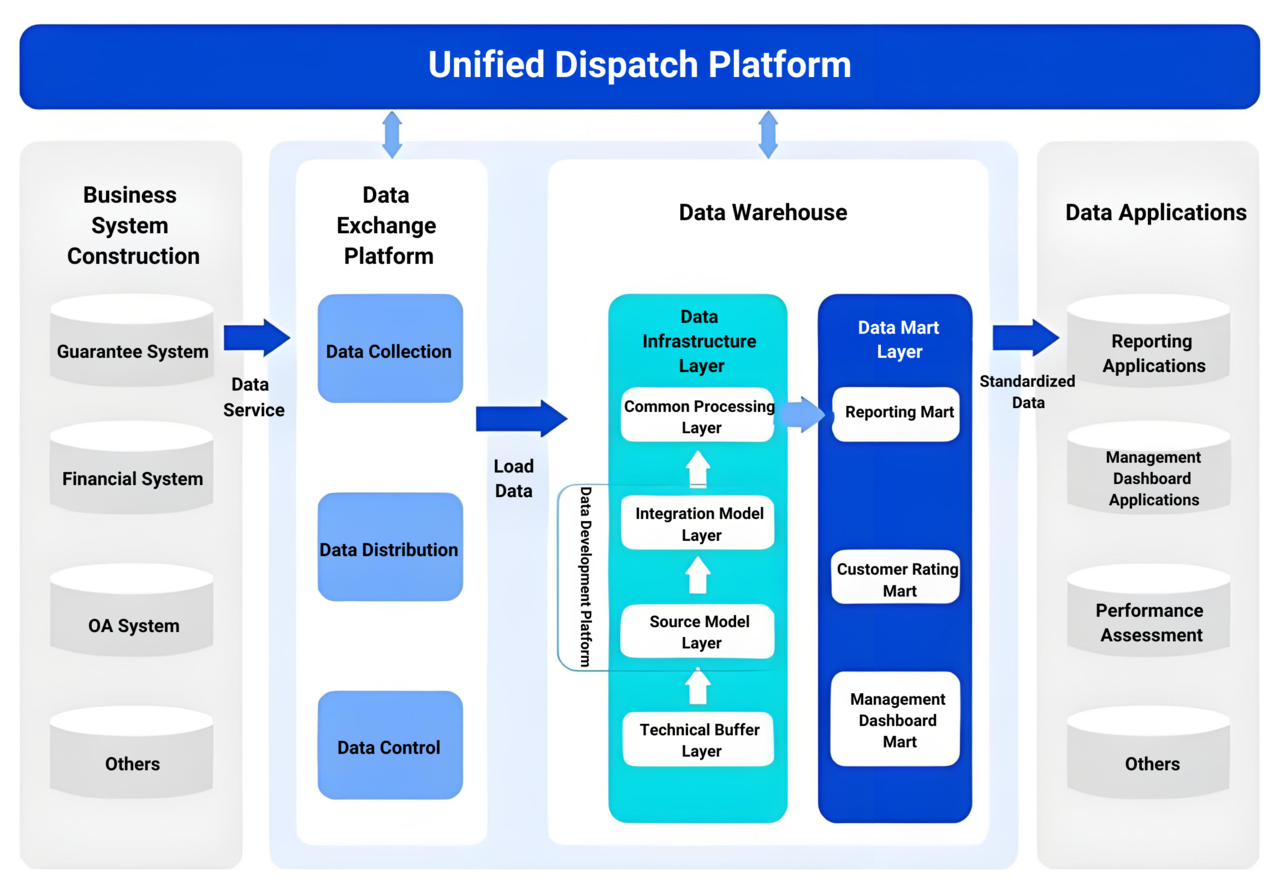

In light of the current status and future roadmap of Longjiang Agri-Guarantee's data platform, the project team has devised a comprehensive one-stop solution aimed at incrementally advancing each interconnected phase. This approach seeks to broaden data sourcing channels and establish a robust data resource ecosystem centered on agricultural guarantee operations. By leveraging core data assets, the plan ensures unified data collection, processing, storage, service delivery, and governance, thereby unlocking the full value of data to facilitate informed business strategies and foster a sustainable industrial ecosystem.

Foundational Platform Setup: Develop a well-structured foundation encompassing overall architecture, data architecture, deployment architecture, and data application architecture. This will enable centralized data acquisition, loading, processing, and provisioning, tailored to Longjiang Agri-Guarantee's IT landscape while incorporating industry best practices for deployment configurations and software setup.

Unified Data Acquisition and Isolation Resolution: Integrate disparate internal data from guarantee, finance, office automation systems, and external sources, achieving T+1 or near-real-time data capture. This consolidation forms a unified data panorama, eliminating data silos and furnishing Longjiang Agri-Guarantee with a comprehensive, precise, and timely data backbone.

Customized Data Modeling: Referencing the top ten thematic models in finance, eight bespoke thematic models are constructed based on the realities of Longjiang Agri-Guarantee's operations, standardizing business data and enabling historical data lineage tracking.

Comprehensive Analytics for Informed Decision-Making: Supply the reporting platform and management dashboard with a diverse range of data interfaces across frequencies, dimensions, and granularities, presenting a holistic view of operational performance and trends. This flexibility empowers business users with advanced analytics and insightful business acumen.

Efficient, High-Quality Reporting: Capitalizing on the data warehouse's enhanced quality and standardized models, data integrity and processing speed have significantly improved, fulfilling reporting standards while optimizing resource allocation and minimizing expenses.

Impressive Achievements:

Pioneer in the Digitalization of the Agricultural Guarantee System

Longjiang Agri-Guarantee's groundbreaking new data platform became operational on March 31, 2024, marking substantial achievements since its launch.

At the operational level, the platform has ensured the timeliness, stability, and precision of data reporting tasks, and played a pivotal role in supporting a management dashboard display during a collaboration ceremony with ten provincial banks.

On the technical level, the platform introduced comprehensive architectural innovations:

Native Distributed Databases: Utilizing distributed storage and processing systems, it accelerates data read/write operations, reinforcing system reliability and scalability, and swiftly addressing data querying and analytical needs.

Full-Stack Information Technology Application Innovation Infrastructure: The data warehouse is comprehensively built on domestically driven information technology application innovations, ensuring steady operation within the domestic ecosystem, thereby securing the safety, reliability, and efficiency of data governance.

Low-Code Development Approach: Integrating Changliang Tech’s data exchange, development, and scheduling platforms has enabled configurable and automated data handling processes, enhancing development efficiency and effectiveness.

Complete Cloud Migration: Deployed on Heilongjiang Government Cloud, all systems leverage unified cloud resources, minimizing redundant digital infrastructure investments, optimizing resource allocation, and reducing construction and operational costs.

The successful rollout of Longjiang Agri-Guarantee's data platform sets a firmer footing for its "asset-light," "lean workforce," tech-empowered modern rural finance strategy, symbolizing a full-scale transition into a new digital development era.

Blueprint for the Future:

Empowering with AI, Elevating with Data Intelligence

Longjiang Agri-Guarantee's current data warehouse primarily handles batch-processed structured data. In the future, it will support a more diverse range of data types, including structured, semi-structured, and unstructured data.

By harnessing advanced analytics technologies, the data platform can integrate data from various sources, providing deeper and more comprehensive business insights. This transforms the data platform from a mere repository of historical data into a platform capable of supporting real-time analysis and unlocking additional data value.

The data platform will explore incorporating cutting-edge technologies such as large-scale models to enhance the efficiency of data cleansing, transformation, and analysis, reducing manual intervention and improving the accuracy and efficiency of data processing. An intelligent data platform can automatically adjust resource allocation and optimize query performance based on business needs, delivering more precise data analysis results.

In the future, Sunline will continue to monitor Longjiang Agri-Guarantee's evolving business needs, continuously optimizing and refining solutions to create greater value in financial services for rural revitalization.

About Longjiang Agri-Guarantee

The Heilongjiang Provincial Agricultural Financing Guarantee Co., Ltd., as a pioneering provincial policy-based agricultural credit guarantee institution, specializes in offering financing solutions to agricultural operators, driving industrial upgrading and rural revitalization in Heilongjiang Province. With a registered capital of 6.58 billion RMB and a comprehensive financial service network, the company effectively alleviates financing challenges in agriculture, stimulates rural economic growth, and contributes to the modernization of agriculture in Heilongjiang and across China.

About Sunline

Sunline as a leading enterprise in the fintech sector, specializes in providing intelligent financial IT solutions to global financial institutions, accelerating their digital transformation. Leveraging its profound expertise in core banking systems, data analytics, and internet finance, Sunline empowers banks, securities firms, funds, and more to streamline operations and enhance data-driven capabilities. By integrating cloud computing, big data, and artificial intelligence technologies, Sunline constructs secure and efficient digital platforms, fostering innovation in financial services and significantly contributing to the worldwide digitalization of economies.