Recently, Guangzhou Bank's credit card customer relationship management (CRM) system was successfully launched. The project is led and implemented by Sunline Technology, aiming to implement the "customer-centric" marketing service concept, and help Guangzhou Bank's credit card business to achieve refined customers from customer management, product management, sales management, marketing management, customer analysis, etc. manage. At the same time, the system uses domestic software and hardware from servers, operating systems to databases, middleware, and browsers to build a safe and controllable data environment, becoming the first pilot project of Guangzhou Bank Credit Card to realize full-stack innovation!

With the advent of the digital age, the banking industry is facing dual pressures from both inside and outside: externally, Internet finance companies have built a highly loyal customer base through extreme product experience and services; internally, the market is becoming saturated, and financial products are at the same Qualitative intensification, leading to user experience less than expected. Faced with a sharp increase in the value utilization needs of customer resources, the "customer-centric" service competition has begun, and customer relationship management will be more deeply integrated into the entire process of bank operations than ever before.

Under the new situation, with the rapid development of Guangzhou Bank's credit card business, the customer base and customer range continue to expand, the level of refined customer management is insufficient, the ability to operate scenarios needs to be improved, and the ability to support digital needs to be strengthened... Various business pain points hit , building a CRM system has become an inevitable choice for Guangzhou Bank's credit card. At the same time, as the credit innovation transformation of the financial industry enters the “deep water area”, the Guangzhou Bank credit card has also pressed the "acceleration key" for the transformation of credit innovation. Take a solid first step.

For 21 years, Sunline Technology has adhered to the management direction of independent innovation, created a complete set of big data products with independent intellectual property rights, and actively built a safe and controllable ecosystem based on the entire financial scene. Solutions, and jointly build a benchmark for IT Application Innovation Industry. The marketing team of Sunline Technology integrates the advanced concept of "big data + Internet", independently researches and develops the customer relationship management (CRM) system, introduces intelligent marketing, scene marketing, event marketing, Internet finance, Internet marketing and other modes, and identifies high-quality and loyal customers. , to provide personalized, differentiated and diversified service experience to achieve the goal of discovering potential customers and retaining valuable customers. At present, it has provided services for Ping An Bank, Minsheng Bank, HengFeng Bank, Ningbo Bank, Guangzhou Bank, Guiyang Bank and Zhengzhou Bank , Jiangxi Bank, Jiangnan Rural Commercial Bank, Qingdao Rural Commercial Bank and other nearly 30 financial customers have built CRM/smart marketing/operation management systems.

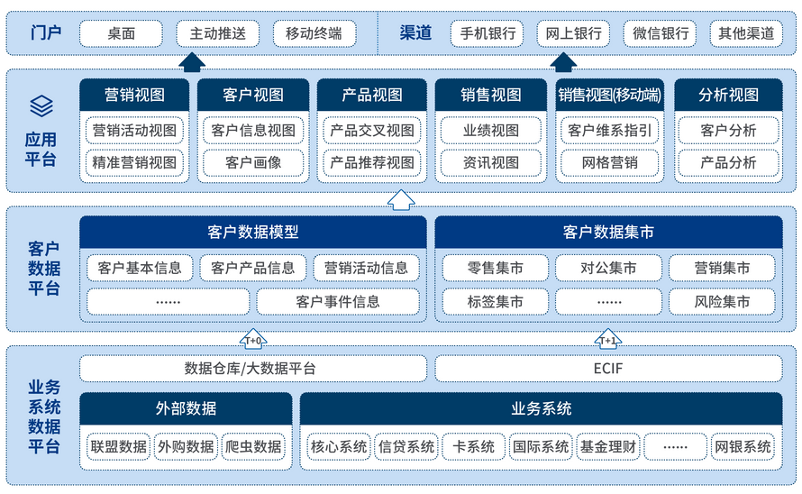

In the credit card CRM system project of Bank of Guangzhou, Sunline Technology built a full-stack, safe and controllable customer management system for customers based on the bank's IT credit creation plan, including work platform, customer information view, and customer acquisition management 14 major functional modules, such as customer allocation and transfer, and customer follow-up management, support standardized management and operations such as customer management, customer marketing, and customer service, helping banks gain insight into customer value and characteristics, and form a closed-loop support capability for the entire process of the customer life cycle:

Full-stack IT Application Innovation Industry builds a digital security base

Equipped with a full-stack IT Application Innovation Industry platform, it realizes localization from the bottom server to the upper browser, and is well compatible with Haiguang, Kirin, Dongfangtong, ZTE, 360 and other domestic leading software and hardware manufacturers, and runs stably, fully guaranteeing data security;

Comprehensive customer 360 degree label

Sort out basic tags, including demographic attributes, behavioral attributes, user classification, business attributes, etc.; at the same time, design derivative tags for scenarios, such as "forgotten repayment family", "job seekers" and other scene tags to create a 360-degree customer view portrait System, so as to improve the bank's precise service and management capabilities for customers;

Marketing Process Automation Management

Support batch processing functions of business opportunities such as automatic dispatch, mandatory dispatch, closing dispatch, etc., and can edit the distribution rules. At the same time, the business opportunity manager can deal with timed-out business opportunities or abnormal business opportunities accordingly, and control the effect of branch dispatch orders based on the monitoring page , and provide functions such as timeout reminders to assist in the processing of business opportunities;

Flexible configuration of process management

Through the flexible configuration and management of process nodes, the efficient transfer of system tasks between different positions and different businesses can be realized, and the online interconnection of banking business can be promoted;

Break through related system barriers

Effectively guarantee the organic combination of direct sales channels and other channels, and maximize the value of channels. Taking the opening of the telemarketing system as an example, the potential customer data is obtained from telemarketing, and is intelligently assigned to the account manager based on the CRM potential customer rules or manually assigned to the account manager to realize the automatic management of potential customers.

The transformation of financial credit innovation and digital construction are not achieved overnight. Sunlight Technology will adhere to the concept of openness and win-win, innovation and striving to advance hand in hand with ecological partners. At the same time, it will focus on its own advantages in the financial industry to deeply understand the customer needs and markets of financial companies structure to help it determine the direction of differentiated transformation and realize refined customer relationship management that meets the requirements of the new era.